Old home

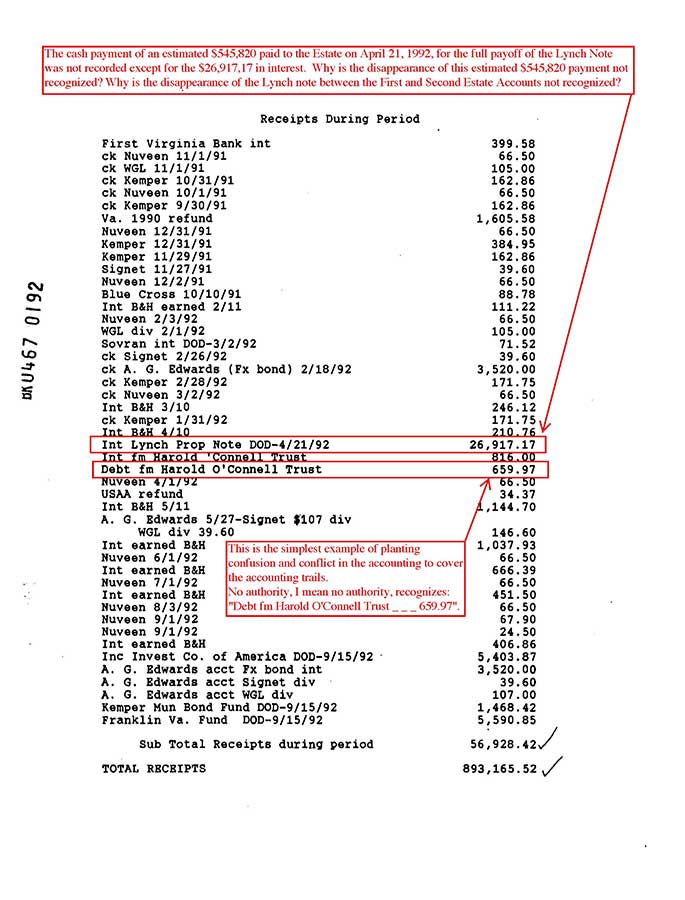

A $659 accounting entanglement is planted to cover-up the disappearance of $518,903.

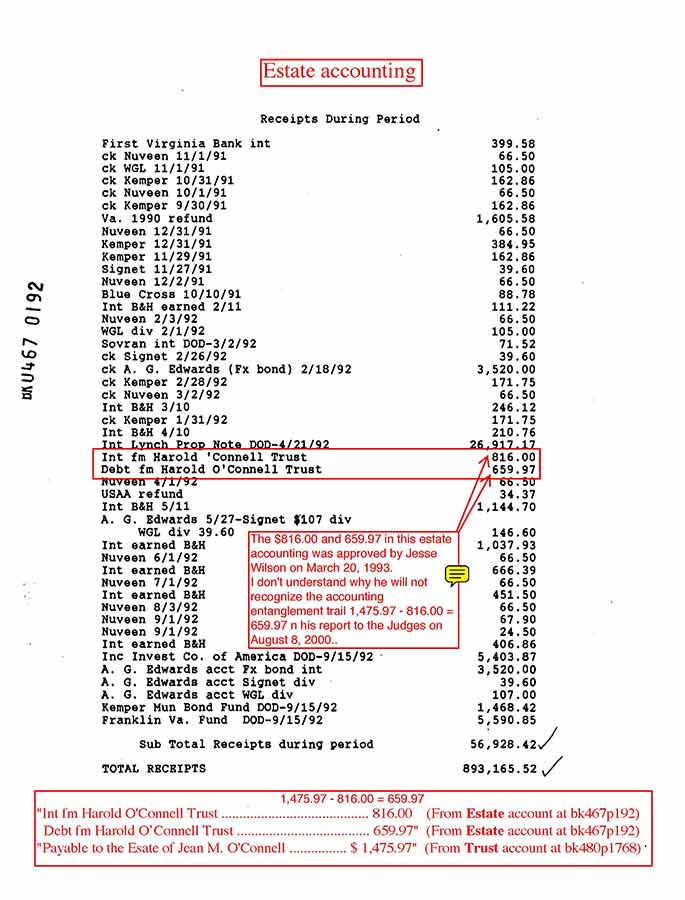

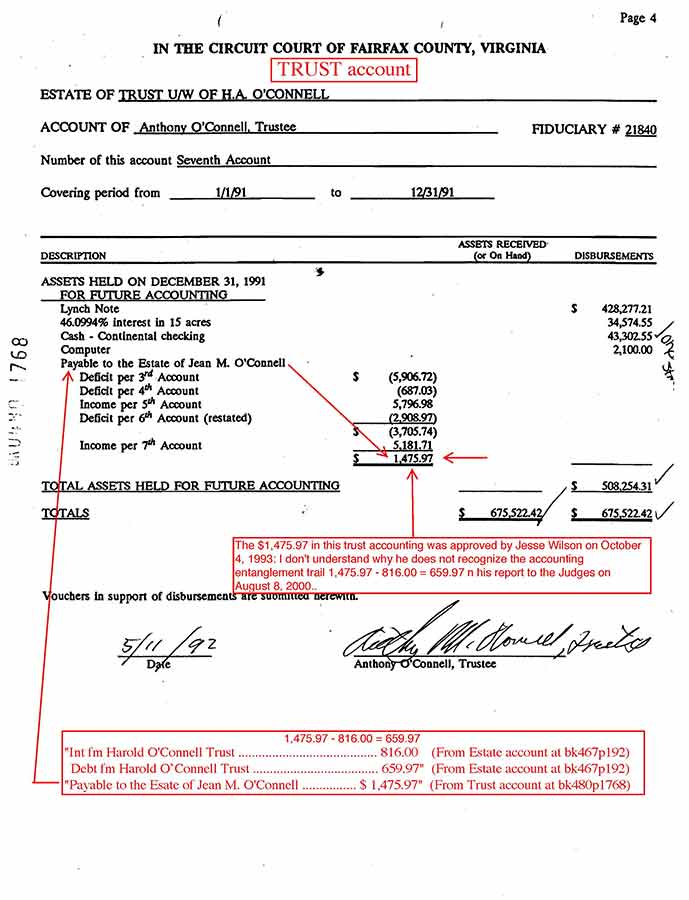

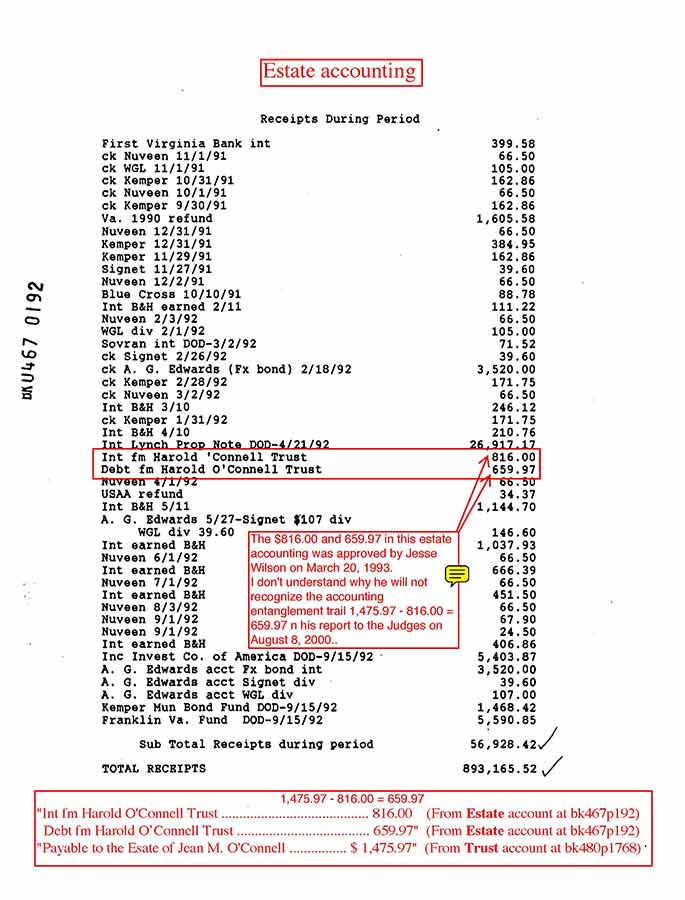

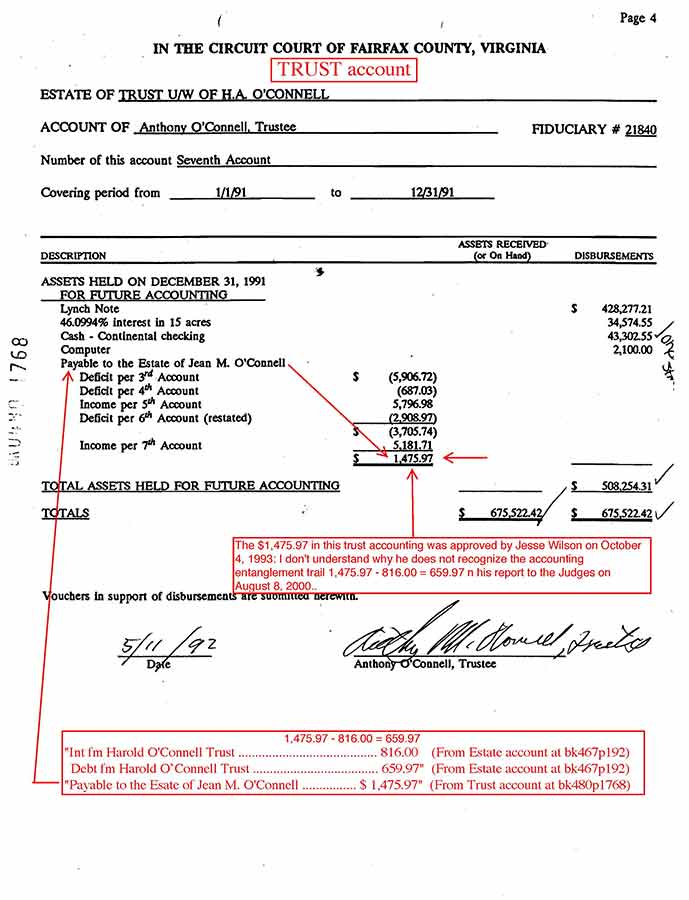

1,475.97 - 816.00 = 659.97

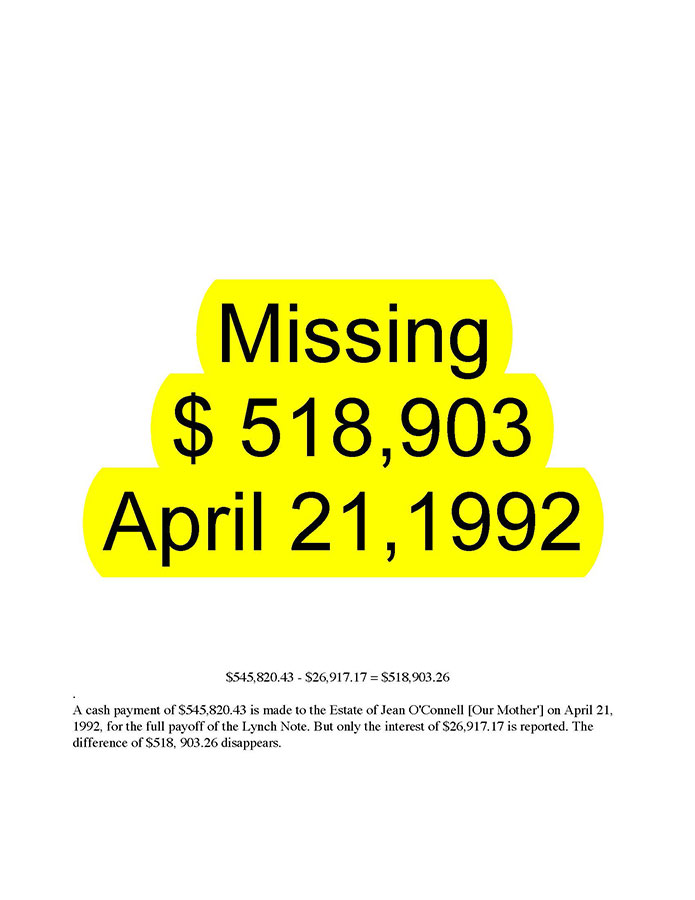

545,820.43 - 26,917.17 = 518,903.26

The only protection a family has against these accounting fraudsters is for every member to recognize the patterns before it's too late. Learn to recognize the planting of accounting entanglements.

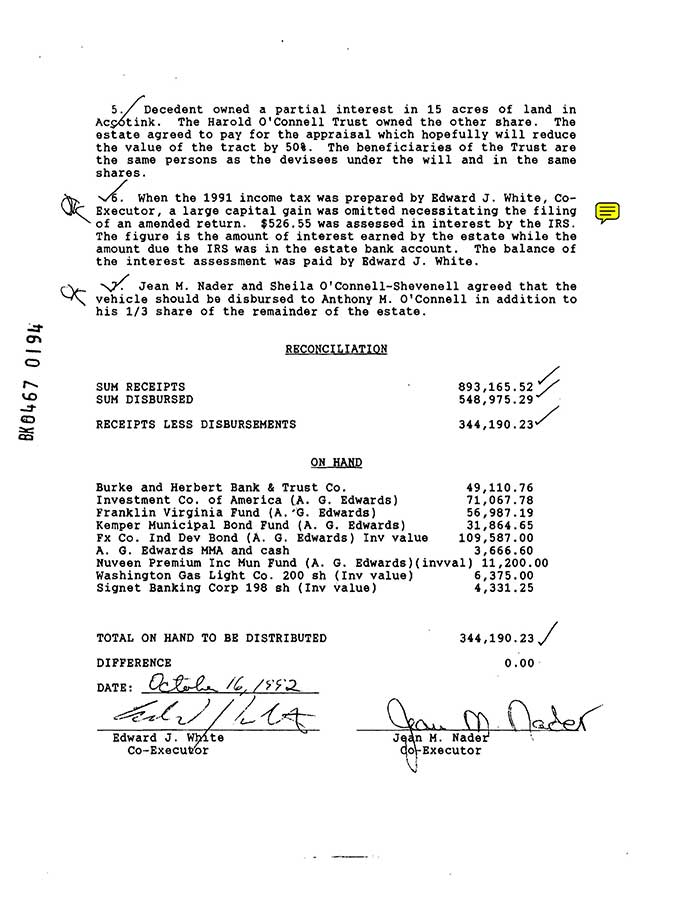

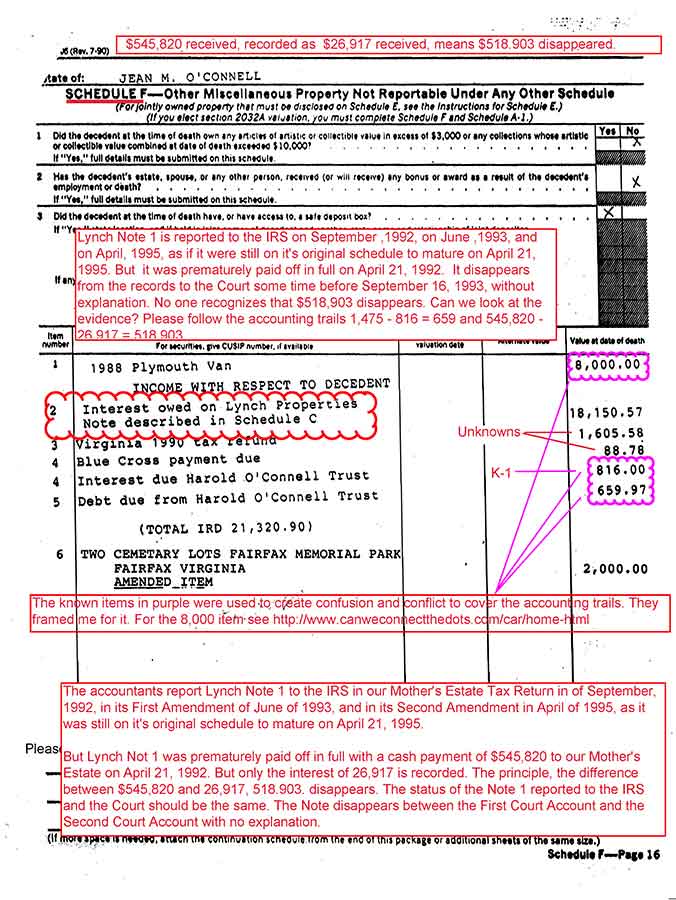

The accountants plant an accounting entanglement of $659.97 between our Mother's Estate and our Father'sTestamentary Trust to cover-up the disappearance of $518,903.26 from our Mother's Estate.

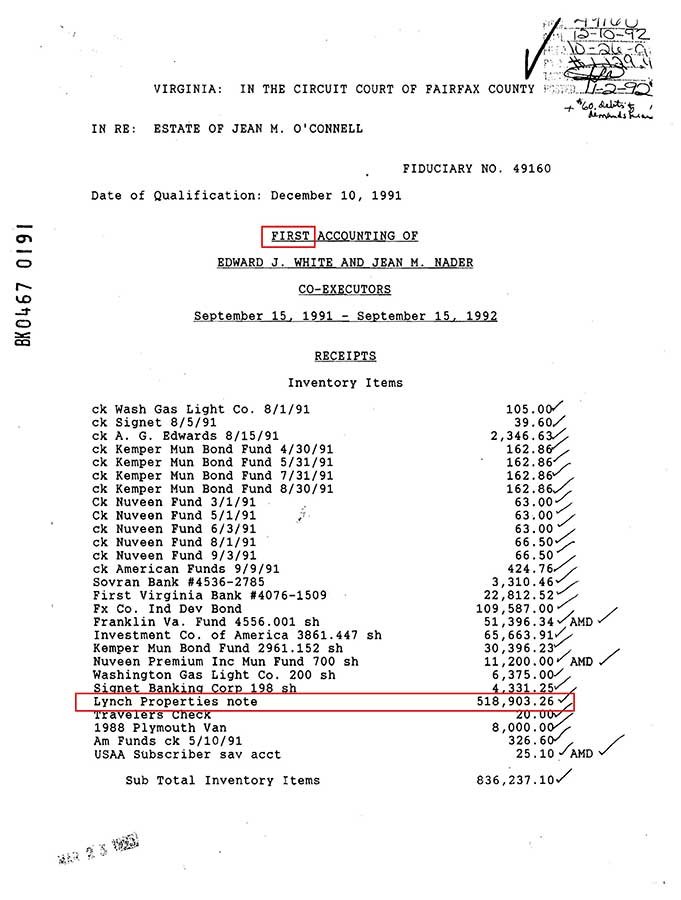

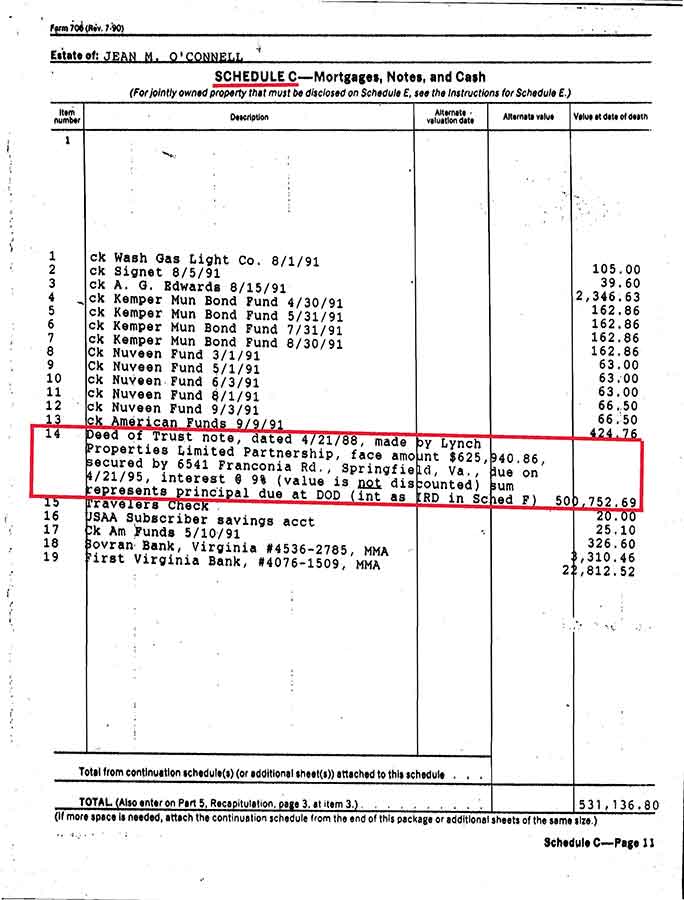

Lynch Note 1 is scheduled to mature on April 21, 1995. But it is prematurely paid off in full on April 21, 1992. $545,820.43 is paid but only the interest of $29,917.17 is recorded. The difference of $518,903.26 disappears.It is not reported to the IRS or to the Court. It should be.

The accountants make $518,903.26 disappear from the full payoff of the Lynch Note on April 21, 1992. $545,820.43 is received but only $29,917.17 [the interest] is rcorded. The difference of $518,903.26 disappears. The difference is not reported to the Court or to the IRS. The Lynch Note is reported to the IRS as if it were still on its original schedule to mature on April 21, 1995. The Note disappears from the Court records with no explanation.

The Lynch Note is reported to the IRS on Schedule F if it were still on its original schedule to mature on April 21, 1985.

By covering it with accounting entanglements and by reporting it to the IRS that the Note was still on its original schedule to matre on April 21, 1995. The Notice disappears from the Court records with no explanation.

Lynch Note 1 in our Mother's Estate was scheduled to mature on April 21, 1995. But it was prematurely paid off in full on April 21, 1992, with $545,820.43. But only $26,917.17 was recorded. The difference of $518,903.26 disappears between the First and Second Court account with no explanation. But it continues to be reported to the IRS as if it was still on it's original schedule to mature on April 21, 1995.

- - - - - - - - - - - - - - - - - - - - -

1992.02.25 (Edward White to Anthony O'Connell, copy to Jean Nader)

I have received your letter of February 24, 1992 in which you request that I reconsider my refusal to resign as co-executor of your mother's estate. Once more I decline to take such action.

When your mother approached me about changing the co-executors of her will, we discussed the matter at length. She specifically desired to make the changes which are in effect now, and was quite firm in her decision. It would be clearly disloyal of me to dishonor her intentions.

If you are represented, I will be glad to discuss this matter with your counsel.

Sincerely, Edward J. White"

1992.03.30 (Anthony

O'Connell

to Edward White) (Copy to Jean Nader)

"I have a few questions I hope you would be kind enough to answer.

1. As you know, the Lynch Limited Partnership plans to pay my Mother's estate $545,820.43 on April 21, 1992. What is your best guess as to when and in what amount(s) you will make distribution(s) to the beneficiaries?

2. The license plates on my deceased Mother's Van expire in April of 1992. Virginia DMV requires a new title with the new owners name before they will issue new plates {The plates cannot be renewed by the co-executors signing for Jean O'Connell). The bank will give the co-executors the title if you simply pay them the interest on the loan. I understand the principal on the loan has been paid and I am guessing that the interest is something in the range of $1200 to $1400. Would you please pay the bank the interest so they will give you the title? What is your decision as to who gets the van and how much will it costs?

3. What is your fee for being co-executor of my mother's estate?

Yours truly, Anthony

O'Connell

"

1992.04.04 (Edward White to Anthony O'Connell, copy to Jean Nader)

"I have received your letter of March 30, 1992.

The answers are:

Question 1. As soon as the money is received, the tax liabilities evaluated and upon consultation with the Co-Executor.

Question 2. Paid. It is not my decision as to what it will cost you, though I have been informed that you know full well.

Question 3. 2 Y % of the receipts into the probate estate if approved by the Commissioner of Accounts.

I would call to your attention that on two separate occasions I drove to Sovran and spent a lengthy period of time on the question of the car loan. I did this in person since: I knew that you had the vehicle, that your sisters wanted you to have it, that the insurance and tags were due to expire soon and I did not want you to be inconvenienced. I could have done all of this by mail and it probably would have taken about three months, knowing the nature of the loan problem. I assumed I was doing you a favor.

Now I receive you letter asking that I "simply pay them the interest" I paid the interest and principal in one check on March 12, received the title on March 22 and mailed it to Mrs. Nader to sign over to you on March 23. Have you any suggestions as to how it could have gone faster?

The information of the commission was given to you previously by Mrs. Nader.

I do not know what your problem is, but in the future, please address all correspondence to Mrs. Nader. (Comment- FATAL; DIVIDE AND CONQUER IS FATAL)

I am trying to be patient with you, but I find that this estate is time consuming enough without having to deal with letters such as the last two that I have received.

Sincerely, Edward J. White"

1992.05.19 (Edward White to Anthony O'Connell, c/o E.A. Prichard, copy to Jean Nader) aka "Blueprint"

"In your letter of May 6 to Jean you asked that I communicate with you with regard to the Harold O'Connell Trust.

I am trying to prepare the estate tax, and as usual in these cases, there are problems trying to understand the flow of debts and income.

I do have a few questions which are put forward simply so that the figures on the Trust's tax returns and accounting will agree with the estate's.

1. The K-1 filed by the Trust for 1991 showed income to your mother of $41,446.00. The Seventh Accounting appears to show a disbursement to her of $40,000.00 plus first half realty taxes paid by the trust for her and thus a disbursal to her of $1794.89. If these two disbursals are added the sum is $41,794.89. This leaves $348.89 which I cannot figure out. It could well be a disbursal of principal and not taxable.

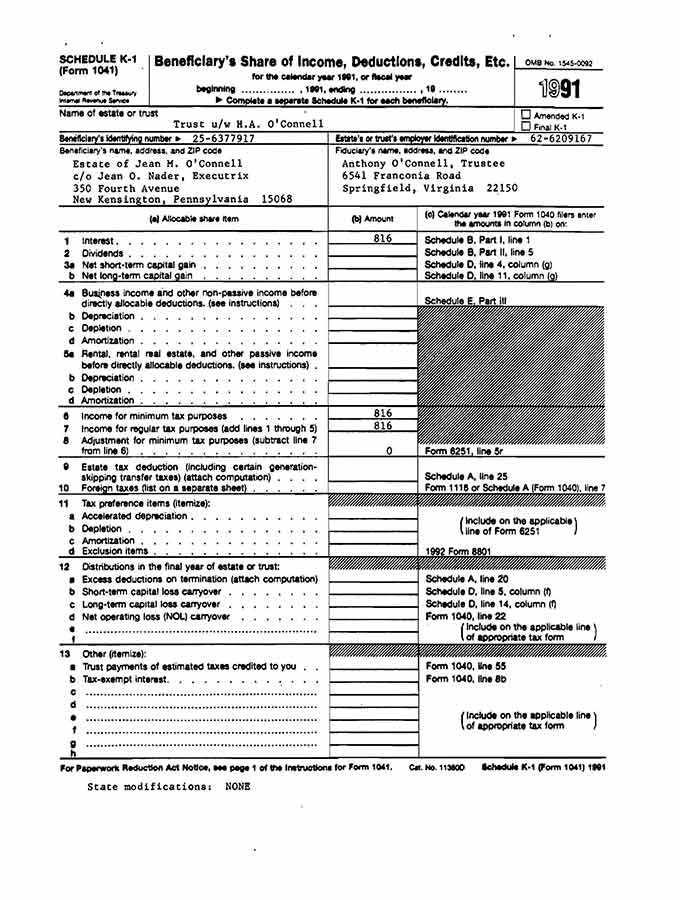

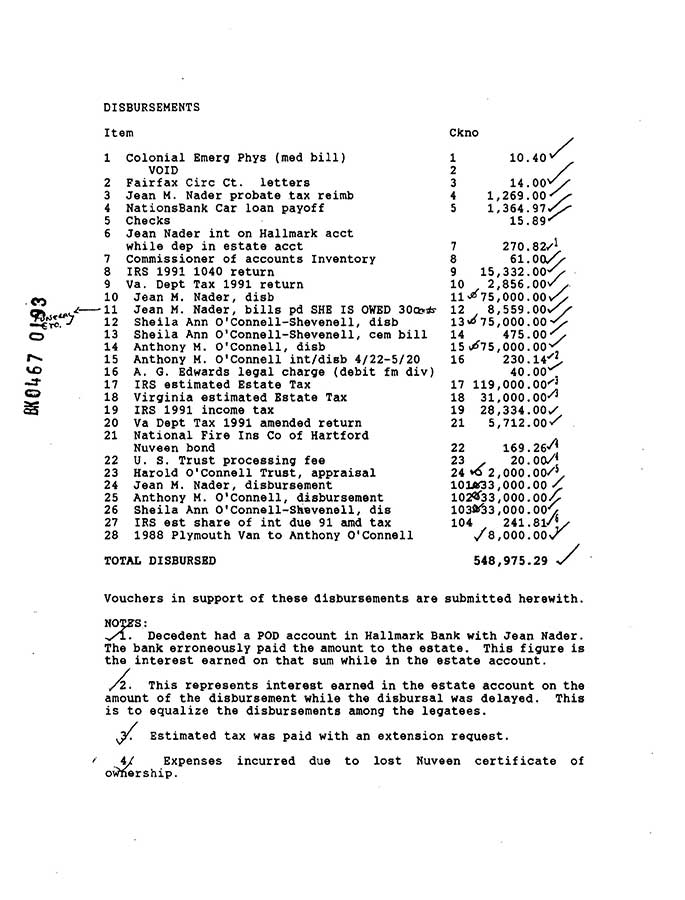

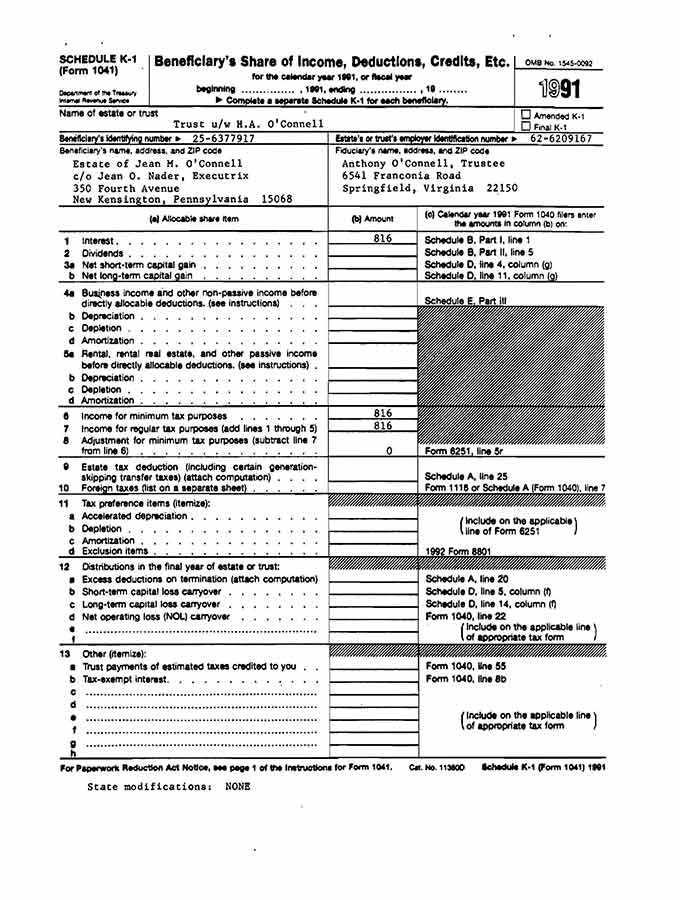

2. The K-1 filed by the Trust showed a payment of $816.00 in interest to the estate. You sent a check in the amount of $1475.97 to the estate. What was the remaining $659.97? Do I have this confused with the tax debt/credit situation which ran from the Third Accounting?

3. On the Seventh Accounting "Income per 7th Account" is shown as $5181.71, but I cannot figure that one out either.

I am of the opinion that the estate owes the trust for the second half real estate taxes from September 15, 1991 through December 31, 1991 in the amount of $1052.35. This is shown on your accounting a disbursed to the heirs. Should this be paid back to the heirs or to the Trust?

I believe that the income received from the savings accounts from September 15 to the date the various banks made their next payment to the Trust (9/30 and 9/21) should be split on a per diem basis, since the Trust terminated on her death. This will be a small amount of course.

Are there any other debts which your Mother owed the Trust?

I realize that [the CPA] Jo Ann Barnes prepared this and if you authorize it I can ask her to help me out.

Please understand that I have no problem with the Accounting, I m just trying to match things up. In the long run, since the beneficiaries are the same, the matter is academic. Please send the bill for the appraisal whenever you receive it. Jean is filing the Fairfax form for re-assessment in her capacity as a co-owner in order to give us a better basis to get this assessment changed and to meet the county's deadline. It will state that the appraisal you have ordered will follow. I think this will be to all of your benefit in the long run.

Sincerely, Edward J. White"

1

Trifecta

Trifecta

Three numbers that create the accounting entanglement 1,475.97 - 816.00 = 659.97

The accounting trail 1,475.97 - 816.00 = 659.97 is a very simple example of an accounting entanglement. It entangles the Estate accounting with the Trust accounting. It's uncanny how good this simple example is as a guide to recognizing the complicated dynamics.

An accounting entanglement as the term is used here is the intentional planting of confusion and conflict in the accounting. Whoever controls the entanglement (the accountants) controls the people and assets that are entangled. Small numbers are used to make them appear unworthy of attention, as if the issue were the amount. The issue is not the amount. The issue is that they entangle. It is a tool. It is an invisible hook, wedge, and cover.

The accounting trails at bk467p191 are covered with entanglements using small numbers. If you can recognize the dynamics in the clear and simple example 1,475.97 - 816.00 = 659.97, you can recognize the same dynamics in the complicated entanglements. The patterns are the same.

1992.05.19 (Edward White to Anthony O'Connell, c/o E.A. Prichard, copy to Jean Nader) aka "Blueprint"

"In your letter of May 6 to Jean you asked that I communicate with you with regard to the Harold O'Connell Trust.

I am trying to prepare the estate tax, and as usual in these cases, there are problems trying to understand the flow of debts and income.

I do have a few questions which are put forward simply so that the figures on the Trust's tax returns and accounting will agree with the estate's.

1. The K-1 filed by the Trust for 1991 showed income to your mother of $41,446.00. The Seventh Accounting appears to show a disbursement to her of $40,000.00 plus first half realty taxes paid by the trust for her and thus a disbursal to her of $1794.89. If these two disbursals are added the sum is $41,794.89. This leaves $348.89 which I cannot figure out. It could well be a disbursal of principal and not taxable.

2. The K-1 filed by the Trust showed a payment of $816.00 in interest to the estate. You sent a check in the amount of $1475.97 to the estate. What was the remaining $659.97? Do I have this confused with the tax debt/credit situation which ran from the Third Accounting?

3. On the Seventh Accounting "Income per 7th Account" is shown as $5181.71, but I cannot figure that one out either.

I am of the opinion that the estate owes the trust for the second half real estate taxes from September 15, 1991 through December 31, 1991 in the amount of $1052.35. This is shown on your accounting a disbursed to the heirs. Should this be paid back to the heirs or to the Trust?

I believe that the income received from the savings accounts from September 15 to the date the various banks made their next payment to the Trust (9/30 and 9/21) should be split on a per diem basis, since the Trust terminated on her death. This will be a small amount of course.

Are there any other debts which your Mother owed the Trust?

I realize that [the CPA] Jo Ann Barnes prepared this and if you authorize it I can ask her to help me out.

Please understand that I have no problem with the Accounting, I m just trying to match things up. In the long run, since the beneficiaries are the same, the matter is academic. Please send the bill for the appraisal whenever you receive it. Jean is filing the Fairfax form for re-assessment in her capacity as a co-owner in order to give us a better basis to get this assessment changed and to meet the county's deadline. It will state that the appraisal you have ordered will follow. I think this will be to all of your benefit in the long run.

Sincerely, Edward J. White"

Below: The amount reported to the IRS on the K-1 should be the same as the amount reported to the Court. But the CPA Joanne L. Barnes, who did the accounting for the Trust and the Estate, reported $816.00 to the IRS and $1,475.97 to the Court. Because $1,475.97 was reported to the Court, I had to pay $1,475.97.

The public should know that the CPA and attorney team, who pretend they don't know each other, are not held accountable for their accounting.

I believe the accountant's reason for changing their agenda from framing me with creating the 659 (Short for 1,475.97 - 816.00 = 659.97) to their new position that the 659 does not exist, is that anyone recognizing the 1,475.97 - 816.00 = 659.97 trail can't help seeing the 545,820.43 - 26,917.17 = 518,903.26 trail where $518,903.26 disappears.

I believe the accountants original intent in planting the accounting entanglement 1,475.97 - 816.00 = 659.97 was to cover-up the disappearance of the $518,903. But my attempts to bring attention to the 659 has made it a beacon to the 545,820.43 - 26,917.17 = 518,903.26 trail where $518,903.26 disappears.

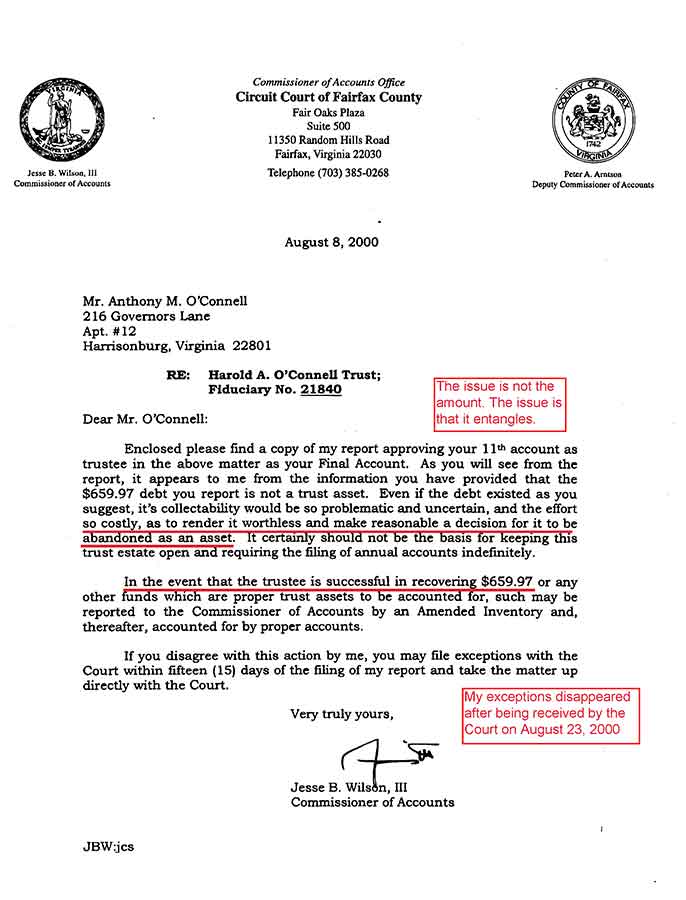

One indicator of the significance of 1,475.97 - 816.00 = 659.97 is the degree that the accountants who created it, reported it, approved it, framed me with it, don't recognize it's accounting trail or any accounting trail for these numbers. History suggests that no one in the Commissioner of Accounts office, in the Court, in the Fairfax County establishment, or in the Virginia establishment, will ever, ever, ever, recognize the accounting trail 1,475.97 - 816.00 = 659.97.

4

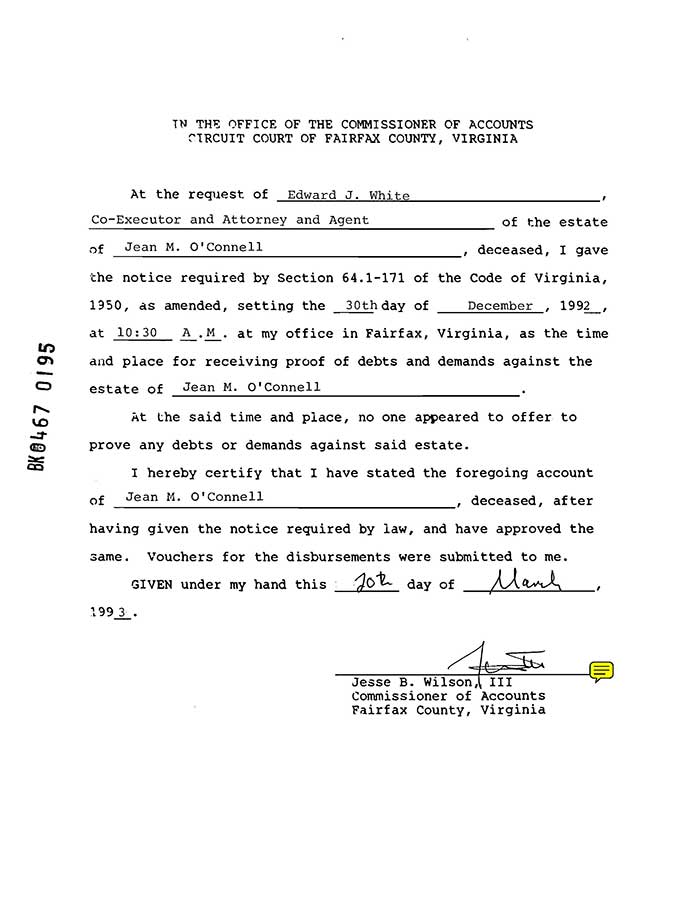

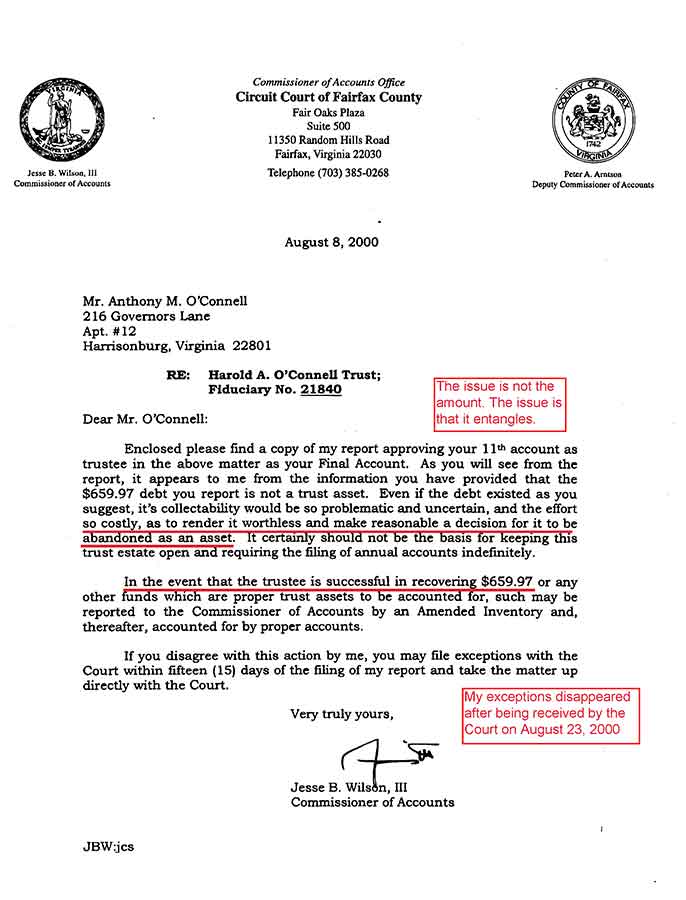

The Commissioner does not recognize the 659

2

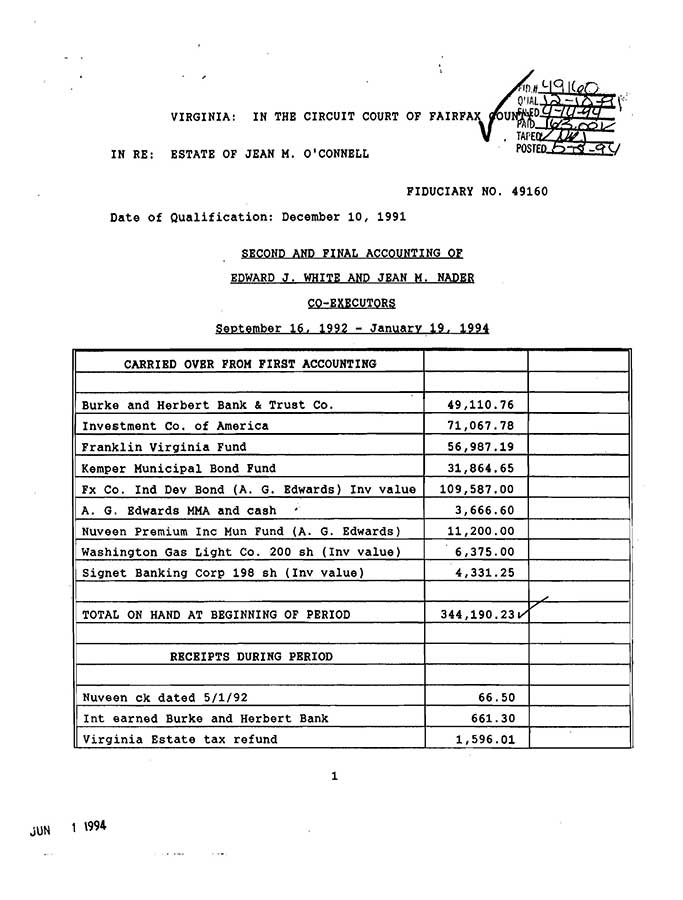

Lynch Note disappears

The Lynch Note dissappears between the first Court Account and the Second Account with no explanation.

Reported to the Court

(above) Second Court Account, in part. Lynch Note disappeared with no explanation..

3

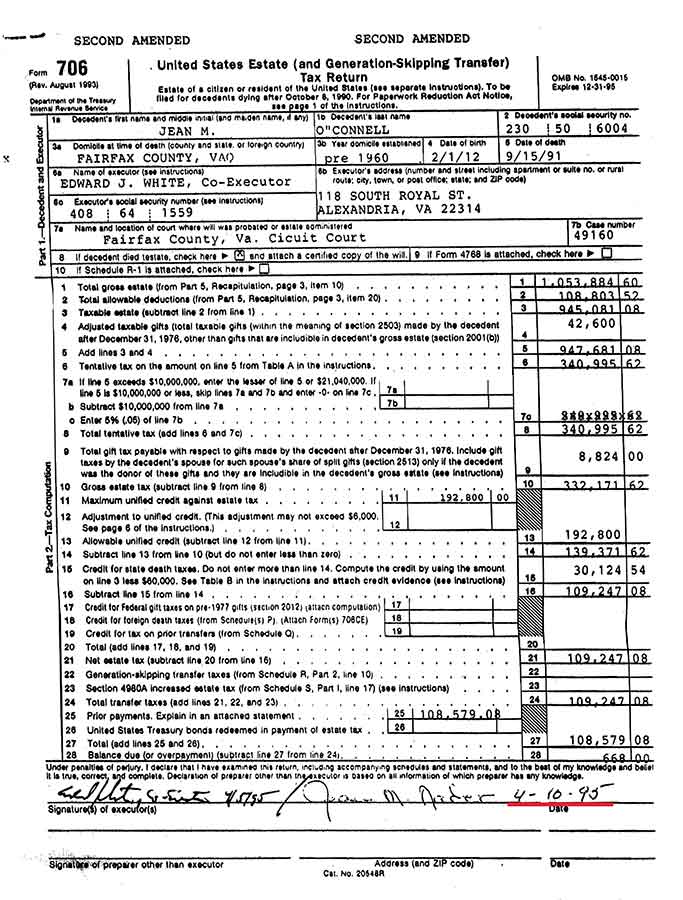

Lynch Note early payoff concealed

Reported to the IRS

Reported as if the Lynch Note was not prematurly paid off in full on April 21, 1992.

(Above) No on recognizes the 659 [659.97] entanglement that covers the disappearance of $518,903. No one recognizes that the Lynch Note is reported to the IRS on September of 1992, in June of 1993, and in April of 1995, as if it was on its original payment schedle to mature on April 21, 1995. As if it had not been prematurely paid off in full on Apri 21, 1992.

The fraudsters created confusion and conflict to cover the accounting trails and made them appear as my fault (Items 1, 4, and 5). I believe they did this to cover the the true Lynch Not trail, to cover the disappearance of the $518,909. I believe they reverse themselves and decided to make it appear as if the 659 did not exist , because it the 1,475 - 816 = 659 trail is recognized, the 545,820 - 26,917 = 518,903 would be recognized.

659trail.com

1,475.97 - 816.00 = 659.97

(Plant confusion and conflict pattern)

The CPA Joanne L. Barnes and the Attorney Edward J. White did this accounting in 1992. They never have to explain it.

The accounting trail 1,475.97 - 816.00 = 659.97 is a very simple example of an accounting entanglement. It entangles the Estate accounting with the Trust accounting. It's uncanny how good this simple example is as a guide to recognizing the complicated dynamics.

An accounting entanglement as the term is used here is the intentional planting of confusion and conflict in the accounting. Whoever controls the entanglement (the accountants) controls the people and assets that are entangled. Small numbers are used to make them appear unworthy of attention, as if the issue were the amount. The issue is not the amount. The issue is that they entangle. It is a tool. It is an invisible hook, wedge, and cover.

The accounting trails at bk467p191 are covered with entanglements using small numbers. If you can recognize the dynamics in the clear and simple example 1,475.97 - 816.00 = 659.97, you can recognize the same dynamics in the complicated entanglements. The patterns are the same.

Trifecta

Three numbers that create the accounting entanglement 1,475.97 - 816.00 = 659.97

The accounting trail 1,475.97 - 816.00 = 659.97 is a very simple example of an accounting entanglement. It entangles the Estate accounting with the Trust accounting. It's uncanny how good this simple example is as a guide to recognizing the complicated dynamics.

An accounting entanglement as the term is used here is the intentional planting of confusion and conflict in the accounting. Whoever controls the entanglement (the accountants) controls the people and assets that are entangled. Small numbers are used to make them appear unworthy of attention, as if the issue were the amount. The issue is not the amount. The issue is that they entangle. It is a tool. It is an invisible hook, wedge, and cover.

The accounting trails at bk467p191 are covered with entanglements using small numbers. If you can recognize the dynamics in the clear and simple example 1,475.97 - 816.00 = 659.97, you can recognize the same dynamics in the complicated entanglements. The patterns are the same.

1992.05.19 (Edward White to Anthony O'Connell, c/o E.A. Prichard, copy to Jean Nader) aka "Blueprint"

"In your letter of May 6 to Jean you asked that I communicate with you with regard to the Harold O'Connell Trust.

I am trying to prepare the estate tax, and as usual in these cases, there are problems trying to understand the flow of debts and income.

I do have a few questions which are put forward simply so that the figures on the Trust's tax returns and accounting will agree with the estate's.

1. The K-1 filed by the Trust for 1991 showed income to your mother of $41,446.00. The Seventh Accounting appears to show a disbursement to her of $40,000.00 plus first half realty taxes paid by the trust for her and thus a disbursal to her of $1794.89. If these two disbursals are added the sum is $41,794.89. This leaves $348.89 which I cannot figure out. It could well be a disbursal of principal and not taxable.

2. The K-1 filed by the Trust showed a payment of $816.00 in interest to the estate. You sent a check in the amount of $1475.97 to the estate. What was the remaining $659.97? Do I have this confused with the tax debt/credit situation which ran from the Third Accounting?

3. On the Seventh Accounting "Income per 7th Account" is shown as $5181.71, but I cannot figure that one out either.

I am of the opinion that the estate owes the trust for the second half real estate taxes from September 15, 1991 through December 31, 1991 in the amount of $1052.35. This is shown on your accounting a disbursed to the heirs. Should this be paid back to the heirs or to the Trust?

I believe that the income received from the savings accounts from September 15 to the date the various banks made their next payment to the Trust (9/30 and 9/21) should be split on a per diem basis, since the Trust terminated on her death. This will be a small amount of course.

Are there any other debts which your Mother owed the Trust?

I realize that [the CPA] Jo Ann Barnes prepared this and if you authorize it I can ask her to help me out.

Please understand that I have no problem with the Accounting, I m just trying to match things up. In the long run, since the beneficiaries are the same, the matter is academic. Please send the bill for the appraisal whenever you receive it. Jean is filing the Fairfax form for re-assessment in her capacity as a co-owner in order to give us a better basis to get this assessment changed and to meet the county's deadline. It will state that the appraisal you have ordered will follow. I think this will be to all of your benefit in the long run.

Sincerely, Edward J. White"

Below: The amount reported to the IRS on the K-1 should be the same as the amount reported to the Court. But the CPA Joanne L. Barnes, who did the accounting for the Trust and the Estate, reported $816.00 to the IRS and $1,475.97 to the Court. Because $1,475.97 was reported to the Court, I had to pay $1,475.97.

The public should know that the CPA and attorney team, who pretend they don't know each other, are not held accountable for their accounting.

I believe the accountant's reason for changing their agenda from framing me with creating the 659 (Short for 1,475.97 - 816.00 = 659.97) to their new position that the 659 does not exist, is that anyone recognizing the 1,475.97 - 816.00 = 659.97 trail can't help seeing the 545,820.43 - 26,917.17 = 518,903.26 trail where $518,903.26 disappears.

I believe the accountants original intent in planting the accounting entanglement 1,475.97 - 816.00 = 659.97 was to cover-up the disappearance of the $518,903. But my attempts to bring attention to the 659 has made it a beacon to the 545,820.43 - 26,917.17 = 518,903.26 trail where $518,903.26 disappears.

One indicator of the significance of 1,475.97 - 816.00 = 659.97 is the degree that the accountants who created it, reported it, approved it, framed me with it, don't recognize it's accounting trail or any accounting trail for these numbers. History suggests that no one in the Commissioner of Accounts office, in the Court, in the Fairfax County establishment, or in the Virginia establishment, will ever, ever, ever, recognize the accounting trail 1,475.97 - 816.00 = 659.97.

4

The Commissioner does not recognize the 659

The Commissioner of Accounts does not recognize the $659.97

5

The B&K law firm does not recognize the $659

The B&K law firm does not recognize the $659.97.

The Complaint prepared by the B&K law firm removes me as Trustee for trying to expose $659.97

http://www.659trail.com

http://www.alexandriavirginia15acres.com

http://www.book467page191money.com

http://www.book8307page1446deed.com

http://www.canweconnectthedots.com (Best reference)

http://www.canwelookattheevidence.com

http://www.chiefjudgesmith.com

http://www.chiefjudgetrumbo.com

http://www.farm139.com

http://www.fbispringfield.com

http://www.followthetrails.com

http://www.followthetrails2013.com

http://www.inreharoldaoconnell.com

http://www.judgesfairfaxcounty.com

http://www.removethesecrecy.com

http://www.stoppedmedicine.com

http://www.tucsonva.com (How big and protected are they?)

http://www.unknownlien.com

|